When it comes to prioritising financial commitments as a self-employed musician, there’s a good chance that a pension will come well down the list. Many musicians are struggling just to stay afloat financially and any talk of investment seems futile if you have nothing to invest.

The 2023 Musicians' Census revealed that UK musicians' average annual income from music work is £20,700 – yet nearly half earn under £14,000. The same survey showed that only 28% of musicians currently have a workplace pension and only 14% have a pension of any other kind.

But whether you are unable to pay into a pension or simply uninterested in doing so right now, it’s worth assessing the options open to you to help plan for the future.

Securing your state pension

The first thing that all musicians should ensure, is that they have paid enough National Insurance contributions to qualify for a state pension.

The UK state pension age is currently 66 but it could rise to 68 by 2044 according to the current government.

To receive a state pension, you will need to have 10 qualifying years on your record and at least 35 years of national insurance contributions to receive the maximum amount of state pension, which is currently £221.20 a week and £11,502.40 a year. The Government Gateway has useful advice on state pensions.

From 6 April 2024, self-employed people no longer need to pay Class 2 NI contributions, but if your profits are more than £12,570 a year, you must pay Class 4 contributions. This is generally paid through self-assessment. You can find out how much state pension you will receive and if there are any missed payments you can make up by logging in to the Government Gateway.

Assessing your future needs

It is unlikely the state pension alone will be sufficient to live on, particularly if you want to live comfortably. So it is important, if possible, to supplement this with additional savings such as a personal pension.

The first step is to assess your needs. The general rule is whatever age you are, save half of that figure.So if you are 20, then put 10% of your income aside or if you are 40, put 20% aside. The next thing to work out is what sort of lifestyle you will need in retirement.

According to the Pensions and Lifetime Savings Association’s Retirement Living Standards, those looking to retire would need annual income of around £14,400 as an individual and £22,400 for a couple, to afford just a minimum standard of living.

For those wanting more financial security and some “treats”, the figure rises to £31,300 per year for an individual and £43,100 per year for a couple. These figures rise to £43,100 and £59,000 respectively for those seeking greater financial freedom and comfort.

Investment alternatives

Of course, some people choose to avoid pensions altogether, opting instead for other forms of investment, such as vintage instruments or other collectibles.

Another source of income for musicians can be royalties.

Session players, for example, can bolster their income with long-term royalty payments for performing on compositions that have been sync’d to TV, film, advertisements or video games.

Investing in the stock market is an option for some people and for them, a self-invested personal pension (SIPP) can be an option. But it’s not for novices, as Claire Dexley, head of financial advice and guidance at online investment management service Nutmeg, explains.

“One thing for everyone to consider when they’re choosing a personal pension is how much managing of their investments do they want to do themselves,” says Claire Exley. “Some people love the idea of the admin, the spreadsheets, watching the markets and considering the macroeconomic environment. If you don’t want to stay on top of these factors, then it’s probably worth leaving the management of your pension and investments to a professional.”

Personal pension plans

The reality is that for most self-employed people, a personal pension plan that is managed for you, will be the best option. There are numerous sites, such as Money.co.uk to help you compare pension schemes.

As any self-employed musician knows, income can be erratic, but many pension schemes now offer flexibility.

“One important thing to consider if you’re self-employed is the flexibility of payments,” says Exley. “If you’re self-employed your income could vary significantly from month to month, and you’ll want the reassurance of knowing you can pause any regular contributions, make ad hoc payments and top-up when it suits you.”

Exley says it is well worth asking providers what flexibility they offer when you are researching your options.

Tax benefits from personal pensions

One benefit of taking out a pension, for sole traders and those trading as limited companies, is tax relief. A basic rate taxpayer for example will receive an extra £25 from the government for every £100 they pay in.

“Personal pensions definitely offer some tax advantages such as the tax relief on contributions from the government,” says Exley. “Your investments also grow free of income or dividend tax and if you’re self-employed with a limited company, some providers will allow you to set up company contributions to your personal pension.

"It is worth considering though if you think you will need any of that money before you turn 55, rising to 57 in 2028, as you may want to use a combination of ISAs and pensions.”

Key questions to ask yourself

Exley advises anyone looking for a pension provider to ask themselves the following key questions:

1. Do I want to choose and manage my investments myself or have someone do it for me? Your answer will determine whether you go for a managed personal pension or a DIY SIPP option.

2. Do I want to be able to manage my pension online? There are numerous digital investment platforms to choose from, so there’s plenty of choice.

3. How much flexibility do I want with payments? It’s really important if you will be able to pause, resume and change the frequency of payments to suit your income pattern.

4. Is there advice or support available? If you want the reassurance of being able to speak to a person, find out what support is available.

Another key factor to consider is charges, as high fees will eat into your money and diminish returns, so always check the fees as these can differ wildly.

One good pension option for anyone with a low income is the government-backed pension Nest, which has some of the lowest charges in the industry and accepts contributions as low as £10. Take a look at the Nest self-employed checklist to see whether you will qualify.

The Musicians’ Union Pension Scheme

One pension scheme tailor-made for musicians is the MU Pension Scheme (MUPS), underwritten by Aviva and administered by Hencilla Canworth.

Over 1,200 MU members have signed up to the scheme so far and 80% of these are self-employed. The MUPS provides employer pension contributions for MU members under collective bargaining agreements with companies such as the BBC, the Royal Opera House, English National Opera and The Globe.

This scheme applies if you are working as an extra or a dep, for example. To check if you are eligible for an employers’ contribution or not, contact your MU Regional Office or Hencilla Canworth.

“The real benefit is that if you work for any of these employers, they already have agreements with the MU in place and they will pay towards the pension,” says Andrew Barker of Hencilla Canworth, who administers the MUPS scheme and provides technical advice on it.

While not all musicians will be eligible for employers’ pension contributions, self-employed musicians working on an ad hoc basis for a number of employers can sign up to a private pension plan under the scheme, the minimum contribution being £16.

The scheme specifically caters for self-employed musicians whose income can be erratic.

“We made sure the MU Pension Scheme was a flexible scheme,” says Barker. “You can increase, decrease, start and stop payments and you can do that as often as you want and there’s no penalty for doing so.

“The MU Pension Scheme has nearly 300 different investment funds and you can be comfortable in the knowledge that it will actually evolve as the markets evolve.”

Ethical investments

In the last ten years, pensions providers have responded to increased consumer concerns about how ethical and sustainable pension investments are. This has resulted in the Environmental, Social and Governance (ESG) standard.

Employers, trustees and scheme managers need to demonstrate that they are effectively managing ESG issues in relation to their scheme. But each individual’s definition of what is ethical can vary wildly, so anyone taking out a pension should check with the provider that their investments meet your criteria.

“Everybody's ethical choices are slightly different,” says Andrew Barker. “This is all about Sustainable Stewardship, making sure the investments are sustainable, so they are not just pillaging everything that's out there, they are making sure that they are working in a responsible way.”

Just get started

One real positive for self-employed musicians is that by working out your needs and putting in the research, you can create a pension that suits your specific needs in retirement. And even if you are only able to start putting aside £10 or £20 per month, the overriding advice is to just start.

“Even putting smaller sums away will help build a pension pot, “ says Claire Exley. “And it’s important not to be put off if you’re a little older. The good news if you’re self-employed is that setting up a personal pension that allows for flexibility [is] more straightforward than you might expect, and there can be significant tax advantages.”

Check out the below case studies, where three self-employed musicians discuss their views of pensions and retirement, or view more information about the MU Pension Scheme.

Paul Russell – Self-employed composer, producer and multi-instrumentalist

Image credit: © John Cook Lynch.

"I'm in no way ready for any of that and I’ve not done anything [about a pension]. It's not something that concerns me, it's something that concerns other people… I’m conscious about paying enough NI contributions [for the state pension]... But truth be told, I can't see a time when I would ever stop working. And it wouldn't be for financial reasons, that would be for joy reasons.

"I like the idea that perhaps PRS payments will take care of me later. I don't know whether that's true or not.

“I imagine that the PRS statements will continue and that will be a sort of living. There is a fair amount every quarter. So I receive PRS payments from all the bands that I play in and then I have done, and continue to do, lots of library music and my own music, which is continually being synced.”

Benjamin Baker – Self-employed violinist

Image credit: © Kaupo Kikkas.

"I make sure my national insurance is up to date and I actually do have a small pension that my parents started for me when I was 19, I took it over from them when I started earning myself.

[On continuing to work as a musician beyond retirement age] “I think that is absolutely my hope because the thought of just stopping at 65 is just a bit bonkers, particularly as so many of my mentors are still very active musicians in their 70s and 80s.

"What gave me pause for thought was actually the pandemic, where it was just so clear right from the outset that continuing doing what we loved doing, and being musicians on the other side of the pandemic, was going to come down to how long we could hold our breath financially. So that’s become a big part of my thinking now too.”

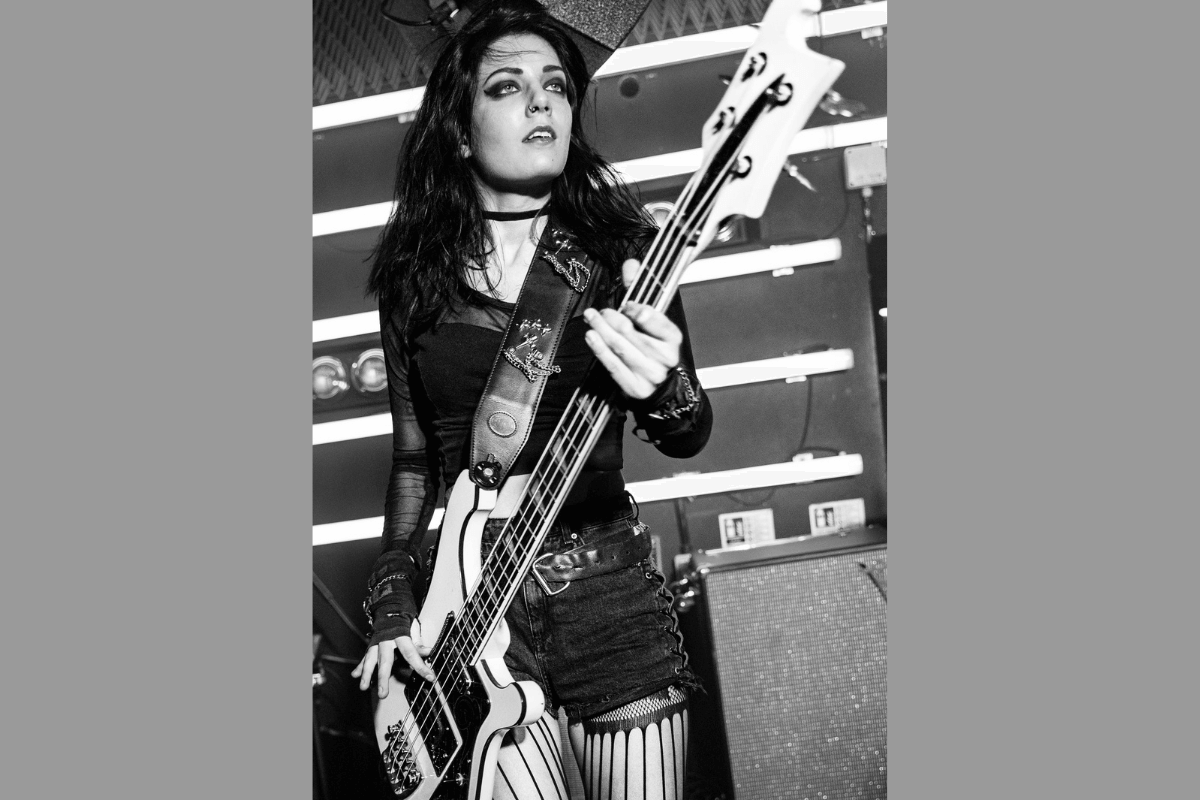

Becky Baldwin – Self-employed bassist and music teacher

Image credit: © Cris Watkins.

“I have honestly never thought about [the state pension] and I don’t know what I would need to pay to qualify. I plan to just keep working and hopefully I can build a comfortable life that gets easier when I am less able to work. I’m sure I’ll slow down, but it’s such a big part of my life that I wouldn’t really feel like myself if I wasn’t playing.

“I teach, and I would prefer to be touring, but I can see how teaching will be a more practical way to earn later in life. However, last week in Brazil I bumped into the 74 year old Gene Simmons who is still touring. KISS are over, and maybe at their age it was getting too hard to perform in platform boots, ride a zip line over the audience and spit blood… I’m sure he doesn’t need the money, he’s probably still doing it because he doesn’t know what else to do with his time. That’s what I hope for – to keep playing, even if I have to change how I perform… I’ll do what I can.

“I think a lot of musicians are big dreamers. Myself included. I still have the hope that one day I will have credits on a big song and I’ll be set for life. But if that never happens, I know I can at least keep teaching, and maybe settle into pub gigs for some fun at the weekends. That should be enough for me, even if the pension doesn’t work out too great!”